Advertisements

Which digital account makes the most money: read the text and find out about the best digital accounts to see your money yield automatically.

Experts have been warning for some time that savings accounts are not the ideal place to keep your money, especially because they are not an investment model.

Currently, the Selic rate has increased and made the situation even worse, as the savings yield is lower than inflation.

If you still insist on leaving your money in savings, because you are afraid of investing or find it more convenient.

There is a great alternative. With digital accounts, you can save your money and earn more than a savings account, without having to invest in anything.

Advertisements

This is because the return is based on the CDI rate. In today's article, you will learn about some of these digital accounts.

So, keep reading! See our index below:

Which digital account makes the most money?

Which bank yields the most?

And what about digital savings?

Which banks have integrated digital savings?

And how much is savings yielding today?

What are the investment options with 120% of the CDI?

What is the value of the CDI today?

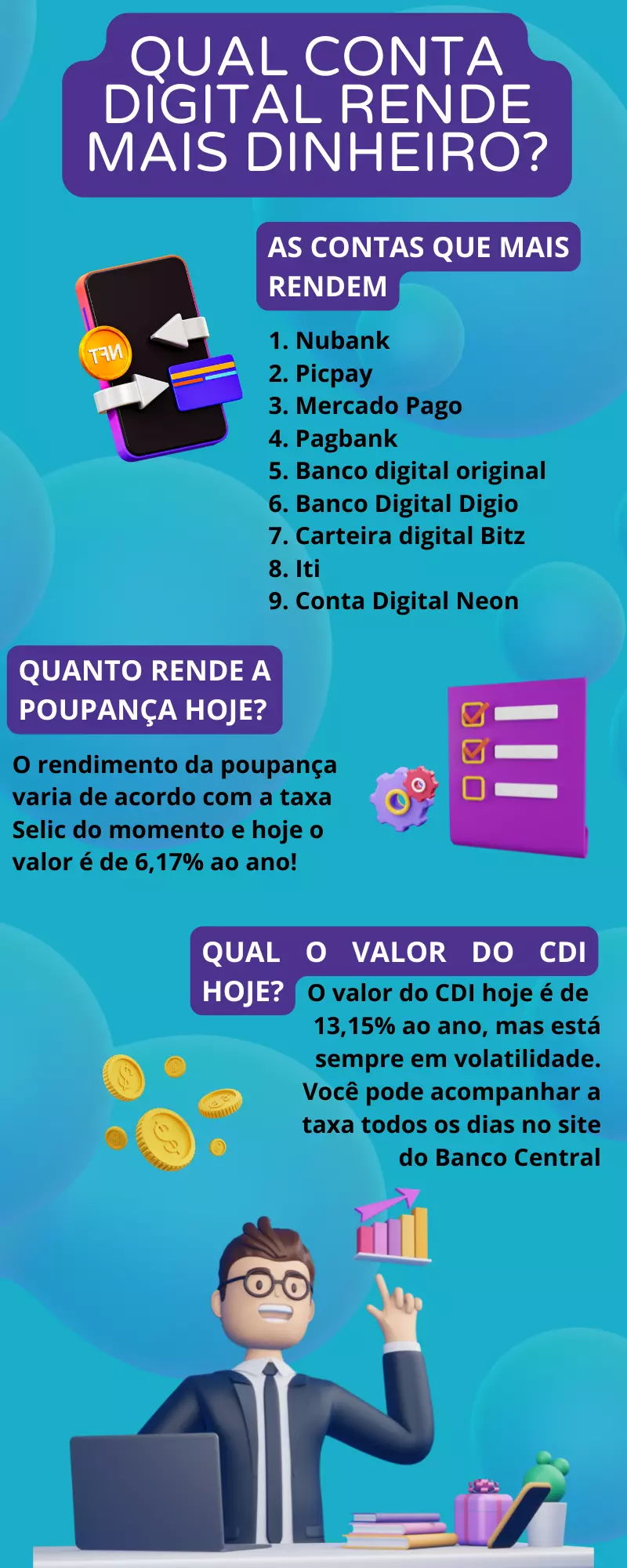

Which digital account makes the most money?

To know the exact answer, it is necessary to compare the percentage of each bank, this is because each one has its own rate of return, but all based on the CDI.

One of the advantages of these accounts is that the money is available for you to use whenever you want.

However, if your focus is income and using this tool as a form of investment, think long term and leave the money for longer, just deposit it.

Now, let's see Which digital account makes the most money?

Nubank Account and Income

With the Nubank digital account, your money yields 100% of the CDI. The profitability is daily and can reach 1.9% per year.

At Nubank you can opt for planned withdrawal and set a specific date to withdraw your money.

In addition, you have access to the Nu Invest platform, which is entirely focused on investments, and you can take a little more risk and invest your money in a fund, for example.

PicPay Rendimento is the digital account that yields the most money

Node PicPay, your balance up to R$250 thousand has a daily yield of the CDI. Currently, the percentage is 102%, however, the fintech is always changing.

A few months ago, it was yielding up to 210% of the CDI. So, is it a great option to leave your money earning interest? Yes.

However, you need to always keep an eye on the percentage and transfer the money when you find a more advantageous one with a fixed rate.

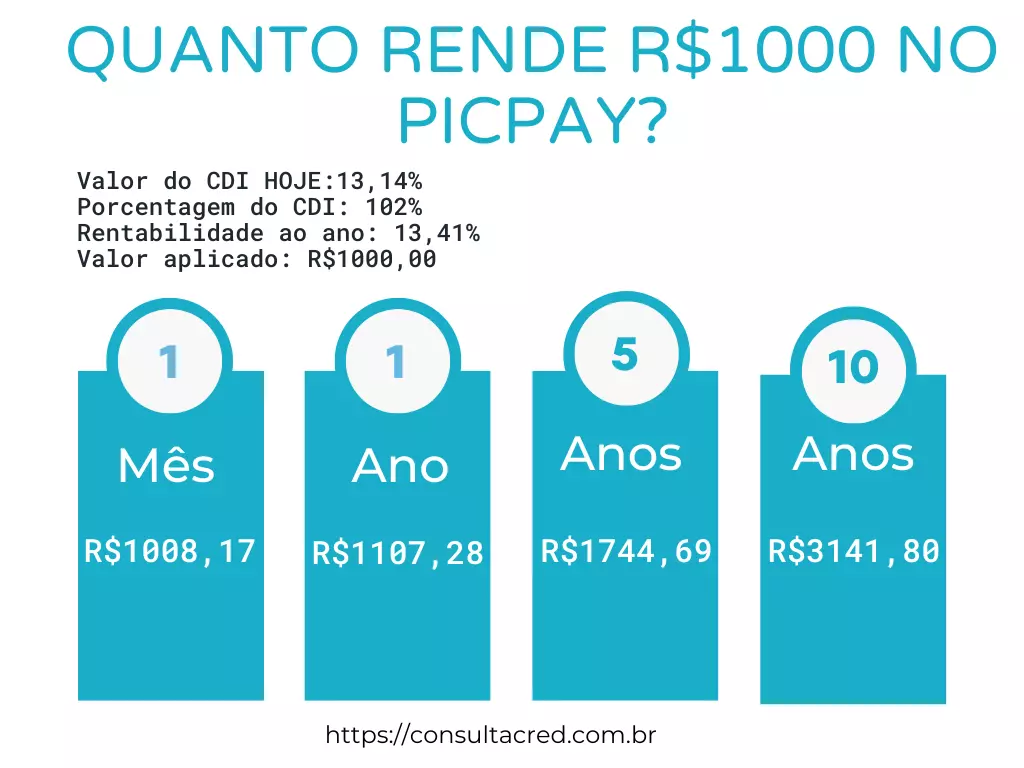

How much does 1000 yield on Picpay?

If you are looking for an account to invest in and want to know how much 1000 yields on Picpay, you have found the answer you needed. As we have seen, the current CDI rate for the digital wallet is 102%.

Therefore, an investment of 1000 reais at a CDI rate of 13.15% that results in an annual yield of 13.41% has a monthly net yield of R$8.17 (already added with the income tax discount if there is a settlement in less than 6 months).

Picpay Simulator

To date, Picpay does not have a simulator, so our team has prepared a table with approximate values according to the CDI of the current date, which is 13.15% multiplied by 102% of the CDI, which gives an annual yield of 15.78, as you will see below.

Mercado Pago

Which digital account makes the most money?

Mercado Pago easily applies to the answer to this question. It has daily liquidity and yields up to 100% of the CDI.

Another way to see your money grow in this fintech is by investing in cryptocurrencies. However, it is a fickle investment and you may see your money go down the drain as well.

PagBank PagSeguro: the digital account that yields the most money if you invest in CDB

PagBank was one of the first banks to offer automatic income on its digital account.

Currently the rate is 100% of the CDI and has a liquidity period of 30 days. There is an option to leave the money for longer, thus, you can obtain a higher return.

There is no maximum value limit.

Original Digital Bank

Banco Original's rate is 100% of the CDI, liquidity is also 30 days, however, it requires a minimum investment of R$100.00.

In other words, you will only see your money yield results after 30 days and having R$100.00 in it.

Furthermore, if you move the money before 30 days, the yield is only 10% of the CDI.

The money does not start earning automatically, you need to activate this option in settings initially.

Digio Digital Bank

Digio's digital account yields 100% of the CDI, with no minimum amount. The account is completely free and the credit card can be obtained with a low score.

Bitz Digital Wallet

This digital wallet costs R$$10.00 each time you open an account. In addition, the money automatically yields 100% of the CDI. Liquidity is daily and there is no maintenance fee.

THE Bitz There is no credit card, just a prepaid card and the virtual account card.

Iti

Your money in the Iti Itaú digital account yields 100% of the CDI and is available for you to use at any time.

Furthermore, there is no minimum value requirement and liquidity is daily.

Neon digital account

In the list of which digital bank makes the most money, Neon is the one that yields the least. This is because the rate is only 95% of the CDI, but it can reach 101% if the customer keeps the money in the account for three years.

The income is daily and is covered by the FGC (Credit Guarantee Fund).

Which bank yields the most?

In fact, the higher the Selic rate, the higher the CDI value and the returns on bank investments will also be.

Within our list, the vast majority offer a return of 100% of the current CDI value, with the exception of Picpay currently yields 102% of the CDI and has an annual income of 13,41%, as shown in the graph below.

Therefore, at this moment the bank that makes the most money is Picpay.

And what about digital savings?

With the technological revolution, digital savings have gained a certain prominence when it comes to investment.

Also known as a “savings account”, the account has the exclusive function of storing your money. In this way, the customer is limited only to making applications and withdrawals.

In short, the anniversary of digital savings is 30 days, that is, the value of remuneration is only added after this period.

Therefore, if you withdraw the invested money before the scheduled date, you will not receive the interest.

Which banks have integrated digital savings?

Banco Pan: the famous Poupa Pan

First of all, Banco Pan's digital savings account, the famous Poupa Pan, has a very simple way of saving money, available to all account holders.

However, despite being confused with “savings”, Poupa Pan is a system for saving money in the form of a CDB.

Thus, the account yield is much higher than that of a traditional savings account. However, the investment method is linked to the CDB and is subject to the collection of Income Tax.

Next Bradesco digital savings

Next, Bradesco's digital bank, also offers account holders true savings in a digital way.

The customer invests the money without complications and receives the interest rate on the 30-day anniversary.

Indeed, With just 1 cent you can start investing and there is no income tax charge. In addition, you can withdraw money at any time.

See also 🔜 How to open your digital checking account at Banco Next

Banco Inter digital savings

Like Next, Inter gives account holders the option of saving money in a savings account in a digital way.

The client has the opportunity to withdraw the money whenever he wants, but it is worth noting that the earnings are credited after the 30-day anniversary date. Currently, at Inter the profitability rate is 0.11% am

Caixa TEM digital social savings

Among digital savings, we cannot fail to mention the famous social savings Caixa TEM.

However, the opening is exclusive only for receiving social programs, such as FGTS and aid Brazil.

The remuneration is made up of the reference rate and additional remuneration corresponding to 0.5% per month when the Selic rate for the year is higher than 8%.

However, there is a minimum deposit limit of R$5,000.00, that is, you cannot receive or save money greater than this amount.

And what about savings today? How much are they yielding?

The savings yield always follows the current Selic rate and today this value is approximately equivalent to 6.17% per year, accompanied by a reference rate of 0.1663%.

In one year, the Selic rate has undergone around 11 variations and until now it is at 13.25%. As we mentioned, the savings income is linked to this rate since there are some specific rules that add up the profit:

- When the Selic is greater than 8.5% per year, the yield corresponds to 0.5% per month, added to the TR.

- On the other hand, when the Selic rate is lower than 8.5% per year, the savings yield corresponds to 70% of the Selic value with the Reference Rate.

What are the investment options with 120% of the CDI?

According to what we have seen in this content so far, we have seen that the digital account that yields the most money today has a profitability of 102% of the CDI, currently, as is the case with Picpay.

In addition to digital accounts, there are also other investment options with a return of 120% of the CDI, as is the case with Banco Bari through the CDB Flex investment.

See also 🔜 How to open the Picpay digital wallet

Banco Bari Flex CDB with a yield of 120% of the CDI

If you are still new to the financial world, you are probably wondering: what is this CDB? Right?

In short, the CDB is nothing more than a Bank Deposit Certificate in which the customer will “lend the money to the bank” and receive the amount plus interest.

In the case of Banco Bari, the application yields 120% of the CDI, however it is necessary leave the money in the account for at least 6 months.

Furthermore, you can start by investing just R$$50.00. Simply open your digital account at the Bank through the hassle-free app.

CDB Pag Bank with 120% of CDI

Unlike the PagBank digital account in which the money held there yields 100% of the CDI, the CDB is a more profitable form of investment.

Although, To earn a profit of 120% of the CDI, the client needs to make a minimum investment of R$1,450.00 and leave the money in the bank for a period of 365 days..

The cool thing is that one of the main points is that you have the flexibility to transform this amount into a credit limit.

So, while you let your money earn interest, you have credit available to fulfill your consumer desires.

See also 🔜 All about opening a PagBank account

What is the value of the CDI today? This is the Reference Rate to know which digital account yields the most money

First of all, the CDI is one of the main factors that will define your profit during an investment, whether in a digital account or directly in a CDB bond. Therefore, the higher the rate, the greater the profits will be.

At the moment, the CDI today has a yield of 13.15% per year, but it is always volatile. To give you an idea, this year we started with a rate of 9.15% per year.

In fact, it is possible to check the values updated daily through the Daily Data from the Central Bank.

Which digital account makes the most money? Conclusion

Well, considering the rate, Pic Pay yields more, since it yields 110% of the CDI. However, it is not fixed, the fintech always changes up or down.

The ideal is to choose those that yield more, however, the yield is daily and does not require minimum investment.

If you feel ready to take a little more risk and start investing, Next and Inter banks have great investment fund options that yield good returns.

Take the opportunity to learn about the Nubank digital account and see how to open yours now!