Advertisements

Get all your questions answered about how a credit card with Air Miles works!

Traveling while shopping or paying your bills using credit seems like a lie.

The benefit of points converted into air miles, offered by some companies, makes paying bills more enjoyable in your routine.

Check out how!

How do airline miles work on a credit card?

Credit cards are a great option when your finances are tight and you're short on cash.

Advertisements

Or, simply, in cases of making strategic purchases in which one chooses to pay for the product or service acquired in installments.

Now, have you ever thought if you could benefit every time you use your card?

This is what happens when you use a credit card that works with a points system.

This way, every time you use your credit card, you accumulate points, which can be redeemed for products, discounts or airline tickets, which we call miles.

All this at no extra cost!

For this reason, it ends up being a great option for those who use credit a lot when making purchases.

How to buy airline tickets with credit card miles?

In order to convert points, you must first choose a miles program.

After that, you will define your destination, the amounts spent and, at the time of payment, the discount will be made on top of your air miles.

Simple and fast like that!

The important thing is to always pay attention to strategies for collecting these points and be careful about their expiration dates, so as not to lose the points earned.

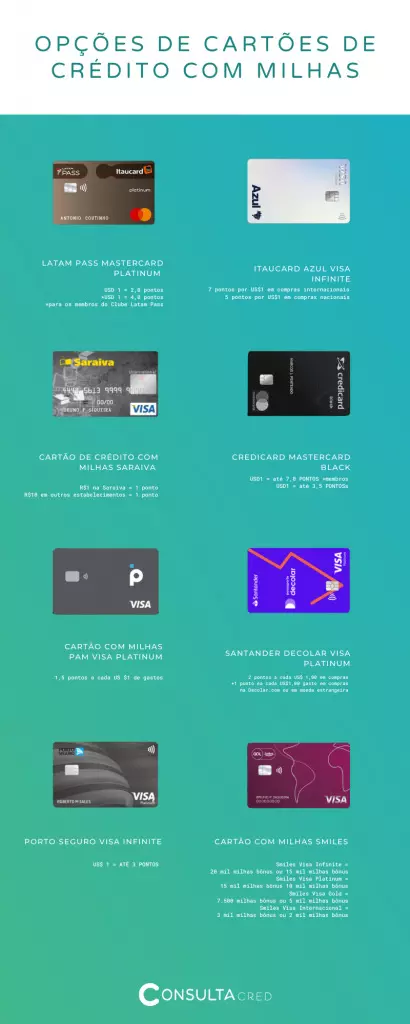

Which credit cards have airline miles?

Latam Pass Mastercard Platinum

How does the scoring system work?

USD 1 = 2.0 POINTS

USD 1 = 4.0 POINTS for Latam Pass Club members

To apply for a Latam Pass Platinum you must have a minimum income of R$1,400,000.00.

You can have a free annual fee whenever you spend the minimum amount of R$4,000 per invoice.

Additionally, in the first year, you also get free annual fees on additional cards.

Your score is based on spending, based on the dollar value, and every year you are offered 3 cabin upgrade coupons, bringing you more comfort on your trips.

The credit limit is a minimum of R$1,600.00, and if you spend R$4,000 during the first 3 months after receiving your card, you can earn up to 8,000 bonus points.

If you are a Latam Pass Club subscriber, you will be entitled to free access to Latam VIP lounges and Latam Airlines tickets can be paid in up to 10 interest-free installments.

How much is the annual fee?

Your Latam Pass Mastercard Platinum annual fee is R$324.00, which can be divided into 12 installments of R$27.00.

However, depending on the amount spent on your bill, you may be entitled to a free annual fee.

If your expenses reach the ceiling of R$1,000 per invoice, you are guaranteed a 50% reduction in the annual fee.

What are the advantages?

- Free annual fee by spending higher amounts per invoice;

- 2 points for every dollar spent on purchases;

- LATAM Airlines flights divided into up to 10 interest-free installments;

- Exclusive promotions for redeeming airline tickets;

- 30% discount on the purchase of LATAM PASS points;

- Insurance and assistance for your trip;

- 50% discount at cinemas in the Itaucard accredited network.

How to apply?

You can make the request online, directly from the Itaú website.

Itaucard Azul Visa Infinite

How does the scoring system work?

The annual fee may be free if your expenses are from R$$20,000.00 per invoice.

Earn up to 7 points per US$$1 on international purchases or up to 5 points per US$$1 on domestic purchases.

You are also entitled to 6 cabin upgrade coupons per year, and you can bring a companion.

Exclusive promotions for redeeming products and tickets, and ordering up to 6 additional cards at no cost.

These are benefits that you will also have, in addition to being able to pay for your Latam Airlines airline tickets in up to 10 interest-free installments.

How much is the annual fee?

The annual fee for the Itaucard Azul Visa Infinite costs R$616.00, which can be divided into 12 installments of R$51.33.

However, if you spend R$1,000 or more on your monthly bills, your annual fee will be free.

If you don't reach the 4 thousand in expenses per invoice, but rather half of that amount, you also have the advantage of being able to reduce your annual fee by 50%. Cool, isn't it?

What are the advantages?

- No annual fee when you spend R$4,000 on purchases per invoice;

- Discounts of 50% on the annual fee for expenses starting from R$ 2 thousand per invoice;

- If you spend R$4,000 per invoice, during the first 3 months after receiving the card, you earn 12,000 points;

- 10% discount on Azul tickets, TudoAzul club, purchase of points and at Azul Viagens;

- 2.6 points per US$ on purchases at Azul and 2.2 points per US$ on purchases;

- 2 free bags on domestic flights and international flights (USA/Europe);

- 1 free bag on flights to South America;

- VIP lounge at Viracopos (international boarding) and Congonhas (domestic boarding);

- Free flight advance;

- Payment in up to 21 installments, interest-free, on Azul tickets;

- Blue Space;

- Points valid for 36 months.

How to apply?

You can make the request online, directly from the Itaú website.

Credit card with Smiles air miles

How does the scoring system work?

Every purchase you make, regardless of the currency used, is converted to US dollars and thus generates miles.

You can earn 1.35 to 2.2 miles per dollar spent.

Miles vary depending on the card model you have.

If you buy tickets on the GOL website, you earn 1 more mile, for example.

Additionally, you can still earn miles if you are a member of Clube Smiles.

Check how many bonus miles each type of card offers:

- Smiles Visa Infinite: 20 thousand bonus miles (Smiles Club customers) / 15 thousand bonus miles (other customers);

- Smiles Visa Platinum: 15 thousand bonus miles (Smiles Club customers) / 10 thousand bonus miles (other customers);

- Smiles Visa Gold: 7,500 bonus miles (Smiles Club customers) / 5,000 bonus miles (other customers);

- Smiles Visa International: 3 thousand bonus miles (Smiles Club customers) / 2 thousand bonus miles (other customers).

How much is the annual fee?

The first annual fee for the card is free and the customer can receive up to 20 thousand bonus miles at no cost.

After this first year, fees can range from R$$286 to R$$1,092 per year.

When you pay your annual fee, you also accumulate miles.

What are the advantages?

- Travel assistance;

- Car rental vehicle insurance;

- International medical emergency insurance;

- Coverage for delayed, lost or stolen baggage;

- Coverage in case of trip cancellation or delay;

- Access to over 800 Lounge Key VIP lounges around the world.

How to apply?

To purchase the GOL Smiles Card: 0800 729 2329.

Credicard Mastercard Black credit card with airline miles

How does the scoring system work?

USD 1 = up to 7.0 POINTS for Latam Pass club members

USD 1 = up to 3.5 POINTS for other customers

You must have a minimum income of R$15,000.00 to apply for the card and get approval.

Additionally, the annual fee can be free whenever you spend R$20,000 per invoice.

Coupons are also available here, allowing you to get up to 6 cabin upgrade coupons per year.

How much is the annual fee?

If your expenses are below R$10,000, you will not receive any discount and your annual fee will be 12x R$100.00 or R$1200.00.

What are the advantages?

- Free annual fee in the 1st year for additional cards;

- Free annual fee spending R$20,000 per invoice;

- With spending starting at R$10,000 per invoice, you guarantee a 50% reduction in the annual fee;

- Spending R$20,000.00 per invoice during the first 3 months, you earn 20 thousand extra points;

- Access to the Latam VIP Lounge, for the cardholder and companion, when flying Latam Airlines;

- 6 Cabin Upgrade Coupons per year;

- Priority boarding on domestic and international flights, for cardholder and companion;

- Mastercard Black VIP Lounge at Guarulhos airport;

- Travel Insurance and Assistance;

- Lost luggage insurance;

- Master Insurance for Cars.

How to apply?

At an Itaú branch or directly through the official website.

Saraiva credit card with airline miles

How does the scoring system work?

For every real spent, the score is as follows:

- R$1 at Saraiva = 1 point

- R$10 in other establishments = 1 point

Points last for 1 year in physical stores and on the Saraiva website and, to accumulate points, simply provide your CPF when making purchases in the store or on the Saraiva website;

In case of purchases in dollars, the conversion is as follows:

US$1 = 0.5 points – Without being a Saraiva plus customer

How much is the annual fee?

The Saraiva credit card is one of the few on the market that has a points program and, even so, offers the lifetime benefit of ZERO annual fees!

Furthermore, there is also no minimum income required to apply for the card.

What are the advantages?

- No annual fee;

- Accumulation of points that can be converted into discounts or airline miles;

- Special offers and discounts;

- Benefits of the Visa program;

- Free additional card.

How to apply?

The Saraiva card can only be requested through the Saraiva and Banco do Brasil websites (at branches, website or app).

Santander Decolar Visa Platinum

How does the scoring system work?

The Santander Decolar Visa Platinum is a card created by Banco Santander in partnership with Decolar.

You will receive 4,000 extra points if you spend R$1,500.00 per month, on the first 4 invoices, after your card arrives.

You will also receive 10,000 points on your Decolar Passport, which will be credited proportionally to the payment of each installment of the annual fee.

How much is the annual fee?

The annual fee for the Santander Decolar credit card is R$552.00, which is charged in 4 installments of R$138.00.

For additional cards, the annual fee is R$276.00, which is charged in 4 installments of R$69.00.

What are the advantages?

- Before your physical card arrives, you can already make purchases online;

- 10,000 points when purchasing the card;

- 2 points for every US$ 1.00 in purchases;

- +1 extra point for every US$$1.00 spent on purchases at Decolar.com or in foreign currency;

- Double points by paying just 3% more than the invoice amount;

- Pay for purchases at Decolar in up to 12 interest-free installments.

How to apply?

Directly through the website by filling out the form.

Pan Visa Platinum credit card with airline miles

How does the scoring system work?

With the Pan Visa Platinum card you have 1.5 points for every US$$1 spent.

As it is a Platinum card, it provides more points in the Pan Mais Program.

This makes the annual fee somewhat expensive.

However, you can reset this amount depending on the amount of your invoice, as is the case with credit cards from other institutions as well.

The annual fee, with a discount according to your expenses, works as follows:

- 25% discount: spending from R$ 1,250.00 to R$ 2,499.00;

- 50% discount: spending from R$ 2,500.00 to R$ 3,749.00;

- 75% discount: spending from R$ 3,750.00 to R$ 4,999.00;

- 100% discount: expenses above R$$5,000.00.

How much is the annual fee?

The annual fee for the holder costs R$$500.00 and is paid in 12 installments of R$$41.66.

For credit cards with additional air miles, you pay R$$250.00, divided into 12 installments of R$$20.83.

What are the advantages?

- CashBack on the invoice;

- Discount at partner companies (Drogaria Pacheco, Drogaria São Paulo, Netshoes, Casas Bahia, Americanas, Asus, CNA, Mobly, etc.);

- Withdrawal or Purchase Under Coercion of up to R$ 3,000;

- Theft or Robbery of the Bag (Protected Bag) of up to R$ 1,000;

- Assistance to victims of crime.

How to apply?

To sign up, simply select the desired card by clicking here, fill in the requested data and wait for the credit analysis.

Once the credit is approved, you will receive the Card at the address you indicated in your registration and after receiving it, you will finally be able to unlock it.

Porto Seguro Visa Infinite

How does the scoring system work?

US$ 1 = UP TO 3 POINTS

The Porto Seguro credit card, unfortunately, is only available to invited guests.

But you can send an email to [email protected], with proof of income and, thus, have a possible approval to acquire the card.

The following documents are considered as proof of income:

– Statement from another credit card in the Infinite and/or Black variant;

– Pay slip for the last 3 months;

– Complete IRPF for the last year and receipt of delivery of the previous year's declaration;

– Bank statements from the individual current account, from the last 3 months.

You must send these documents by email to make this request.

The deadline for making points available is up to 10 business days, counting from the request made at the Relationship Center.

To request the redemption of your points, you must contact the Porto Seguro Customer Service Center directly.

How much is the annual fee?

The annual fee for the cardholder is R$1,500.00, paid in 12 installments of R$1,25.00, while the annual fee for the additional credit card is free.

The annual fee can also be reduced depending on the expenses you have on your bill.

- Annual fee for expenses less than R$ 5,999.99 per month: R$ 125.00;

- Annual fee for expenses between R$ 6,000.00 and R$ 14,999.99 per month: R$ 62.50;

- Annual fee for expenses exceeding R$15,000.00 per month: free.

What are the advantages?

- Up to 3 additional cards, there will be no annual fee on all of them;

- Various free insurance and benefits for your trips, such as travel insurance with Schengen certificate;

- 10 free accesses per year to more than 2,000 VIP lounges in the world's main airports, in addition to unlimited access to the Latitude VIP Lounge.

How to apply?

By invitation of request.

So, now tell me, which credit card proposal with airline miles caught your attention the most and which one you are likely to choose?

Don't forget to take into account all the factors and advantages to find the card that best suits you!