Are you looking for credit opportunities for those with bad credit? Discover 10 credit card options that do not check SPC and Serasa.

Advertisements

In fact, if you are interested in reading this, you certainly have a negative credit rating and are looking for a credit card, right?

In fact, keeping your name clean in times of crisis has become a difficult task. But know that you are not alone.

According to the data from Serasa Default Map, the latest number of consumers with debts is 63.4 million. And this represents the highest number in the index since July 2020.

However, in the credit market it is possible to find several options to meet this need.

Therefore, in this content we have separated in detail the most important information for selecting the best card.

We know that, apply for a credit card with a bad credit rating it is a laborious procedure.

However, it is not an impossible mission, after all, there are good options on the credit card market without consulting SPC and Serasa. In addition, they offer several advantages, such as a points program, discounts and even installments.

Want to know more about credit cards that don't check SPC and Serasa? Follow us!

- Can someone with a bad credit history have a credit card?

- 10 credit card options that do not check SPC and Serasa;

- How to get a credit card with a bad credit history online?

- Which bank approves credit cards with low scores?

Can someone with a bad credit history have a credit card?

If you are in debt, know that you are not alone!

In fact, many are in the same boat, looking for an opportunity to clear their name and acquire a financial product.

In fact, the procedure takes a little longer, as the chances of having a credit analysis approved are much lower.

Furthermore, the name restriction is not the only factor that the bank takes into consideration. In fact, the internal policy of a financial institution always varies from one to another.

In order to reduce the number of defaulters and meet consumer needs, some types of credit cards that do not check SPC and Serasa were released, such as: consigned, prepaid credit card and card with guarantees as is the case with Nubank.

To help you understand better, we have separated a video on YouTube of High Income Cards Channel, see how it works:

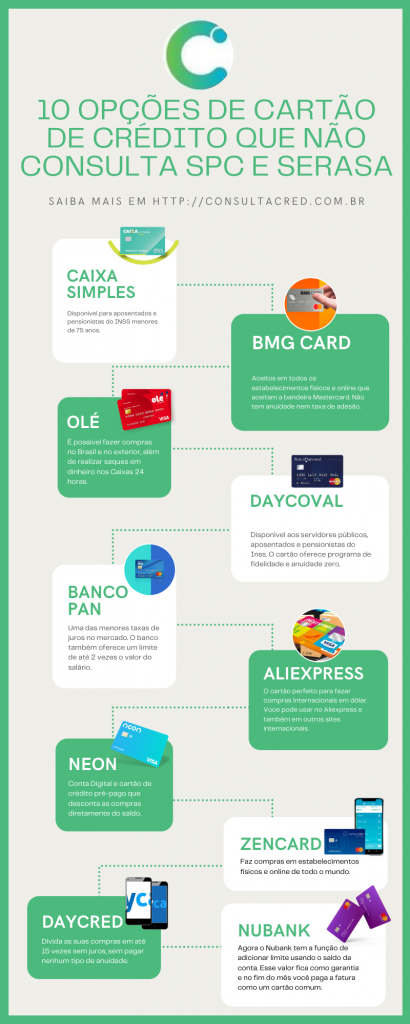

10 credit card options that do not check Spc and Serasa

1 – Credit card without checking SPC and Serasa Caixa Simples!

First of all, Caixa Simples is a credit card that does not require SPC or Serasa credit checks. However, it is intended for a specific group of people: INSS retirees and pensioners, under 75 years of age.

With the Elo international flag, you can make purchases with peace of mind, both in Brazil and abroad.

Above all, part of the card bill is deducted directly from the benefit and there are no annual fees!

2 – BMG Card Mastercard

The second option is the BMG Card, a credit card that does not check SPC and Serasa from Banco BMG.

In fact, it is accepted in all physical and online establishments that work with the Mastercard brand.

Furthermore, the customer does not pay annual or issuance fees to acquire it.

The hiring process is completely online and the requirement for approval is to be retired, an INSS pensioner or a Public Servant.

3 – Credit Card that does not check SPC and Serasa Olé consigned

Firstly, this financial product is part of the Santander Group in partnership with the Visa brand. If you are a civil servant or a retiree/pensioner of the INSS, approval is almost 99.99% certainty!

THE Olé consigned It is international, so you can make purchases both in Brazil and abroad. You can also make cash withdrawals from 24-hour ATMs with reduced interest rates.

Another important piece of information to highlight is the exclusive discounts that the customer receives when making purchases at partner stores of the financial institution.

4 – Daycoval Card

First of all, the Daycoval card This is a loan modality, without consulting the SPC and Serasa.

The card is Mastercard International and is available to public servants, retirees and INSS pensioners.

The difference is that when you select Daycoval, you benefit from the institution's loyalty program. Just as you don't pay any annual fees on your credit card!

5 – Credit Card that does not check SPC and Serasa from Banco Pan

In fact, Banco Pan is one of the institutions that offers the best financial products to INSS retirees and pensioners. When it comes to credit cards, it would be no different.

After all, the creditor institution charges one of the lowest interest rates on the market for revolving credit. With this card, there is no annual fee and the credit limit is up to twice the amount of your salary.

You have the option of making cash withdrawals and paying in installments. Public servants can also have their credit cards approved immediately.

6 – Credit Card without SPC and Serasa consultation ZenCard

Initially, the ZenCard credit card comes with a digital account on Samsung Pay. Through it, the customer makes transfers, withdrawals, deposits and much more!

The ZenCard is a Mastercard card that lets you make purchases in physical and online stores around the world. You can even register it to pay for subscription services like Netflix.

The only negative factor is that to acquire the card the customer needs to pay a membership fee. Currently, the amount corresponds to R$19.90!

Read more: Credit Card That No Need to Take a Photo: Know Your Options!

Credit Card that does not check SPC and Serasa Visa

7 – AliExpress

Already the AliExpress It is a prepaid credit card, so first you top up and then use the available balance.

This option is ideal for the group of consumers who like to make international purchases and are unable to obtain a credit card with a pre-approved limit.

In short, the Aliexpress website is one of the most famous e-commerces in the world. However, to take advantage of the offers you need to have an international card.

As many customers have difficulty acquiring this payment method, the company launched the prepaid credit card in partnership with Visa.

Read also: Good prepaid credit card options!

Top-ups are made in dollars and the customer pays the quote on the day of the procedure.

This means there are no surprises on your bill, as is the case with conventional cards. You can even make purchases on other websites without any problems.

Advantages of a credit card that does not check SPC and Serasa AliExpress

- There are no annual fees;

- Payment confirmation is made immediately;

- You have the option to choose between a virtual and physical card;

- Top-up values are fixed, starting from US$$30.00.

Disadvantages

- Does not make purchases in installments;

- There is an issuance fee of R$3.90;

- There is a recharge fee of R$3.00.

8 – Credit Card that does not check SPC and Serasa Neon

In advance, Neon is a financial institution that has a partnership with Banco Votorantim. Together they offer several lines of banking products, such as digital accounts, credit cards and even loan.

Therefore, to have access to the card, you must first have an active digital account with the Bank. You can carry out the procedure online through the mobile app.

In this sense, the amounts spent are deducted directly from the account balance. In fact, the Neon card is a partnership with Visa and does not have SPC or Serasa checks.

However, to release the installment credit function, the company carries out a credit analysis.

Credit card for people with bad credit with limit

9 – DayCred

First of all, DayCred is a payroll credit card, intended for public servants, retirees and INSS pensioners.

Regarding payment, you can rest assured, as the invoice is deducted directly from the benefit.

Advantages of having a credit card that does not check SPC and Serasa DayCred

Does not perform credit analysis: one of the first advantages is that the card is also available to those with bad credit. Since the institution does not check the SPC and Serasa.

Invoice discounted directly from the benefit: the minimum invoice amount is discounted directly from the benefit. However, no more than 10% can be discounted from the salary margin.

No annual fee: the customer only pays for monthly purchases made with the credit card.

Installments in up to 15 interest-free installments: DayCred's differential is the most advantageous payment method. You can easily pay for your purchases in up to 15 interest-free installments. In addition, you have a 40 days to start paying off the debt.

Mastercard International Flag: possibility of using the card anywhere in the world that accepts the brand.

10 – Nubank – discover the credit card version that doesn’t check SPC and Serasa!

With good reason, Nubak, in addition to having one of the best digital accounts and credit cards, is the pioneer of online banks in Brazil.

Recently, the Startup launched a credit option for those with bad credit, in which the customer uses the account balance and converts it into a card limit.

The procedure works like this: If you make a deposit of R$1,000.00 into the account, it is possible to add it as a credit limit on the card.

Therefore, the money is not deducted immediately, as is the case with other conventional prepaid credit cards. But, it is saved as if it were “a guarantee of payment”.

At the end of the month, the bill is paid normally, just like a conventional credit card. The cool thing is that Nubank has released the function of making purchases in installments using the added limit.

Advantages of a Nubank credit card that does not check Spc and Serasa

- The customer adds limit as many times as they want;

- Increased opportunity to have a pre-approved limit;

- Possibility of redeeming the limit balance at any time;

- No annual fees or charges;

- Option to make payments in installments.

In short, to have access to this modality it is necessary to have a Nuconta open.

Then, add funds to the account and see if the “add more limit” option is available.

In the meantime, the resource is being released to customers little by little.

To understand more about the subject, read our content⤵️⤵️⤵️

“Is it possible to have a credit card with a limit for people with bad credit?”

How to get a credit card with a bad credit history online?

In fact, a negative person has more difficulty having a credit analysis approved. However, make a credit card with a bad credit rating online it is not impossible.

Therefore, to make a good deal and not compromise your financial life, first of all take the following points into consideration:

Evaluate your current financial situation

In fact, having a credit card on hand is a great choice for organizing personal expenses and increasing purchasing power.

However, uncontrolled use causes debt and a series of losses.

Above all, analyze your income and see what percentage of it is committed to debt. That way, you can honor your obligations without suffering.

If your current situation is “in the red”, the best option is prepaid credit cards. With it, you can determine exactly how much to spend and avoid getting into debt.

Analyze the options available in the credit market

Each institution offers different revolving credit conditions and different interest rates, as well as benefits such as points programs, discounts and cashback.

We think you might also like to read 👉” Your cashback guide to always winning”

Therefore, at this point, see if the benefits available meet your daily needs and provide more advantages.

Request your card

After selecting which option best suits your needs, simply make the request.

The vast majority of them can be done online. However, there are also good options that can only be done in physical agencies, as is the case with some Caixa cards.

Which bank approves credit cards with low scores?

In short, the credit score works as a “thermometer” that measures the trust that the bank can have in the customer. Therefore, the tool is a determining factor when it comes to releasing a credit limit or not.

If your score is low, it is recommended that you avoid traditional banks and look for “small financial institutions”, such as sturtups.

To make your search easier, we have selected some options that may work for your profile.

Let's check it out?

Inter Bank: a completely digital bank with a card with no annual fee. One of the differences is the fact that the credit card is linked to the CDD, available even for those with bad credit.

My Page: In this institution, consumers can find a digital account and a 100% digital credit card without bureaucracy. Approval is usually very easy for customers with low scores.

Next Bank: Open your account now without complications, all from your cell phone. Even if your credit is not released immediately, with constant transactions, the bank can have more details about your consumption profile. And thus release the right limit so as not to harm your finances.

Digio: The last bank option that approves credit cards with low scores is Digio. Since the credit analysis only covers the amount of your income and the limit that you already have available within the credit market.

Conclusion

With a credit card in hand, you no longer need to worry about carrying large amounts of cash in your wallet.

Or not having change available when paying the bill. After all, all your expenses are concentrated in just one payment method.

In short, the suggestions presented here, by Cred Consultation These are the best credit card options that do not check SPC and Serasa at the moment.

But, first of all, evaluate your needs and, most importantly, whether your current budget can keep your bills up to date.

After all, when poorly managed, a credit card can become a financial villain. And we are sure that this is not your goal, right?

Take advantage and also read a list with excellent options credit card for self-employed people with bad credit in our blog. Click the button and find out more!